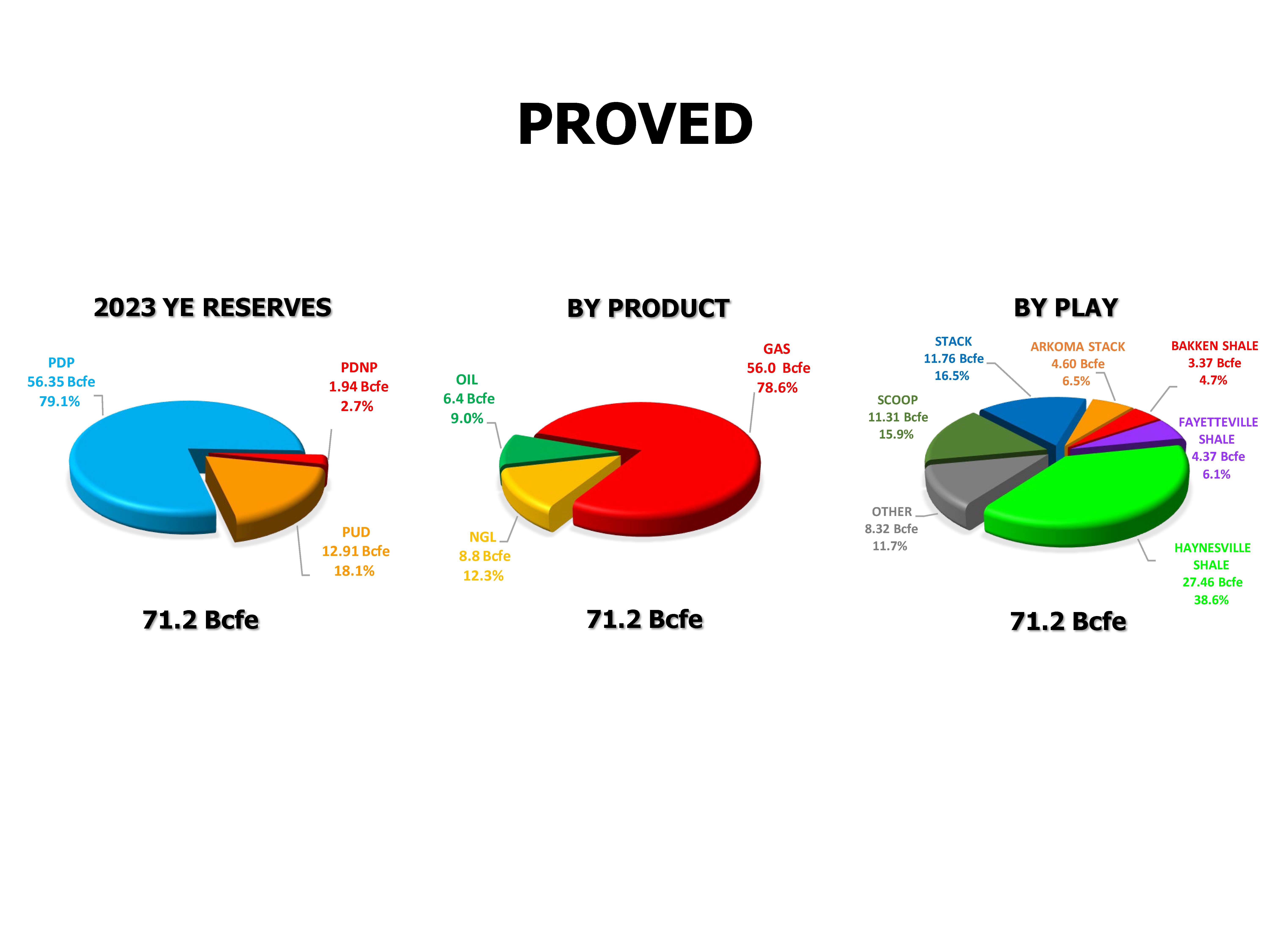

Reserves

At Dec. 31, 2023, proved reserves were 71.2 Bcfe, as calculated by Cawley, Gillespie and Associates, Inc., the Company’s independent consulting petroleum engineering firm. This was an 11% decrease, compared to the 79.7 Bcfe of proved reserves at Dec. 31, 2022. Total proved developed reserves decreased 12% to 58.3 Bcfe, as compared to Dec. 31, 2022 reserve volumes, mainly due to sales of working interest properties in the Arkoma Stack and Eagle Ford Shale. SEC prices used for the Dec. 31, 2023 report averaged $2.67 per Mcf for natural gas, $76.85 per barrel for oil and $21.98 per barrel for NGL, compared to $6.52 per Mcf for natural gas, $92.74 per barrel for oil and $39.18 per barrel for NGL for the Dec. 31, 2022 report. These prices reflect net prices received at the wellhead.

Year-End 2023 Proved Reserves